Inspiration can come to you all of a sudden.

I had already talked with lahikmajoe about prices and tea and when we met in the 1st ITTC, he told me a story about two identical teas that had a huge difference in price, all depending if you buy in one store or in another.

Interesting no?

Then I read a couple of articles about tea, price and value:

Generation Why: The price of tea in Teavana by Hilary Matheson from the Journal Standard posted on July 17, 2011 http://www.journalstandard.com/lifestyle/x920793235/Generation-Why-The-price-of-tea-in-Teavana

Price and sustainability: What is Overpriced Tea by Alex Zorach from the Alex Zorach’s Tea Blog posted on August 1, 2011 http://cazort.blogspot.com/2011/08/price-and-sustainability-what-is.html

The Price of Tea by Lainie P from Lainiesips.com posted on July 19, 2011 http://www.lainiesips.com/2011/07/the-price-of-tea/

and I thought, perhaps it is time to answer lahikmajoe’s question or rather to try to do it.

In order to be able to do it, I will make a couple of simplifications since otherwise, it would bring us too far away from the price topic.

-

My example (and it will remain that) will only focus on two different “generic” companies,

-

I will assume that they get the same amount of non-blended tea at the same price from the same company. I know this is a big If but getting into the auction system or the direct buying and coming up with hypotheses based on that would just add complexity to this post,

-

I will use wrong figures but I think they still make sense.

So let’s start!

We have two companies selling teas: A and B (quite imaginative, no? ;))

Both have an online store but A has three stores in different towns while B has only one.

A is widely known for its top quality products while B is nearly unknown outside of its usual customers.

Due to its reputation, A also opened tea houses in its stores while B is still focusing on selling and did not venture in something else.

The scene is set and now we can come to the price.

I will use the price of the tea bought by the two companies as the basis for my calculations (see point 3).

Why? Simply because it is a way of having costs that you can compare.

To make things easier, I will call this price X (another display of my daring imagination).

|

|

A |

B |

|

Tea price (including shipping costs) |

X |

X |

|

Renting the stores |

10%X (the increased percentage is because they need more space because of the tea houses) |

3%X |

|

Sellers’ wage |

12%X (because you have two different categories: those selling tea and those attending the customers) |

2%X |

|

HQ paperwork |

1%X |

0.5%X (done by one of the sellers that might own the shop) |

|

Logistical network |

10%X (with 3 different stores even if they were in the same town, you would need a small warehouse) |

0 (supplies are kept in the store) |

|

Margin |

4%X (since they have a good reputation, they can charge more there since people are willing to pay more for this “better” quality, because of the perceived value) |

2%X |

|

Total and final price |

137%X |

107,5%X |

With this oversimplified example, you end up with a tea that is 1.27 times more costly in A stores than in B one, meaning that if you buy it for 5€/100g at B, you will pay 6.137€ for the same amount of the same tea at A.

The original blends that are still used today have been created in the 1870s-1900s by Pavel Kousmichoff, a real creator , and his recipes were further elaborated by his son.

The original blends that are still used today have been created in the 1870s-1900s by Pavel Kousmichoff, a real creator , and his recipes were further elaborated by his son.

First of all, they have a huge estate in Kenya (14,000 ha), with a total output equal to 10% of their yearly tea production.

First of all, they have a huge estate in Kenya (14,000 ha), with a total output equal to 10% of their yearly tea production.  This unique facility (located in Sharnbrook, North of London) is home to a hundred biologists, nutritionists, aroma experts… (plus 40 scientists in Kenya and 50 testers in India, China, Japan and the United States).

This unique facility (located in Sharnbrook, North of London) is home to a hundred biologists, nutritionists, aroma experts… (plus 40 scientists in Kenya and 50 testers in India, China, Japan and the United States). According to classical economics, prices are the result of the interaction between the quantities of a good supplied by the producers and those demanded by customers.

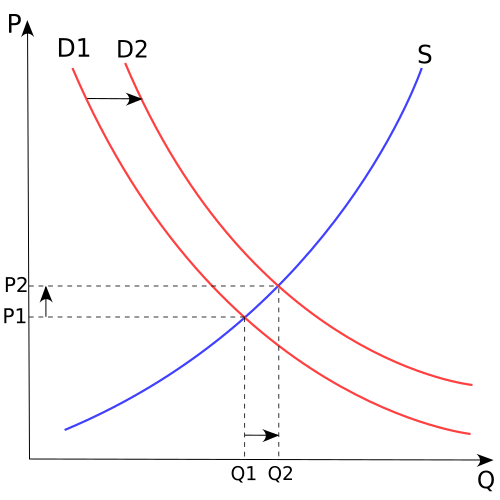

According to classical economics, prices are the result of the interaction between the quantities of a good supplied by the producers and those demanded by customers.

Recent Comments